Stable Value

Stable value investment options have been offered in defined contribution plans since these plans’ inception in the 1970s. Throughout their 40 year history, stable value funds have consistently delivered a unique combination of benefits: liquidity, principal preservation and consistent, positive returns. Stable value’s unique characteristics are governed by the Financial Accounting Standards Board as well as the Governmental Accounting Standards Board.

Initially, stable value investment options invested predominantly in guaranteed investment contracts, or GICs, and typically provided a fixed rate of return over a set time period. At the end of 2018, members of the Stable Value Investment Association reported collectively managing over $839 billion in stable value investments covering more than 179,000 defined contribution plans, which represents more than 10% of all defined contribution assets.

Synthetic Investment Contracts

Over time, other stable value investment contract structures developed. As of December 31, 2018, SVIA members reported that 40% of all stable value investments were in synthetic investment contracts (also known as a synthetic GIC or wrap contract). The purpose of this summary is to provide a foundation for the understanding of synthetic investment contracts.

The synthetic investment contract has two components: first, a portfolio of bonds that are owned by the plan or trust (i.e., the underlying investments) and second, a contract issued by a financial institution (such as an insurance company or bank) that wraps the underlying investments to provide the principal preservation and steady yield expected of stable value. Unlike GICs, this type of contract typically does not provide for a fixed rate of interest over the term of the contract. Instead, these contracts provide a credited rate of return, known as the crediting rate that changes periodically to reflect the ongoing performance of the underlying investments and smooths the returns of the bonds over time. It also ensures that the crediting rate credited to participants does not drop below zero and provides for participant transactions at contract value, which is the invested capital (or principal) plus any accumulated earnings.

(See appendix for a summary of stable value products.)

As the performance of the synthetic investment contract directly depends upon the underlying investments, knowing the basics of bond investing is helpful in gaining a better understanding of stable value synthetic investment contracts.

Bond Basics

When you buy a bond, you are essentially lending money to the issuer of the bond – typically a government or government agency, municipality, corporation, or other entity. In return, the issuer agrees to make periodic interest payments to you on the loan amount (the principal or face value) until the loan is paid in full on the maturity date. The rate of interest that an issuer pays – known as the coupon rate – is determined by factors such as the term of the loan and the issuer’s expected ability to repay the loan. This perceived ability to repay is reflected in an issuer’s credit-quality rating, as determined by a credit-rating agency such as Standard & Poor’s or Moody’s Investors Service.

Factors Affecting Bond Investments

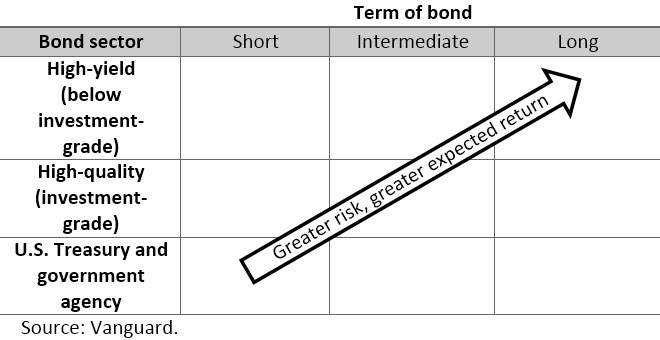

As seen in Figure 1 below, primary factors affecting the performance of a bond investment are the credit quality and term of the bond. Generally, the lower the quality and longer the term, the higher the risk that a bond may lose value. At the same time, the expected return to the participant for taking that risk is also greater. A bond’s value or price can change based on several factors such as changes in credit quality and/or changes in interest rates, which are explained below.

Figure 1. Relative risk of different bond types

Credit Quality:

Changes in the credit quality of the bond or a perceived change in the issuer’s ability to pay interest and/or principal in a timely manner can cause the bond’s price to fluctuate, either up or down. While all bonds are subject to quality factors to a varying degree, U.S. Treasury bonds are commonly seen as carrying the least credit risk, because they are backed by the full faith and credit of the U.S. government. Bonds issued or guaranteed by other U.S. governmental agencies are also considered to have minimal credit risk. Bonds issued by entities such as corporations, municipalities, or other entities (including pools of loans or other receivables) typically carry greater credit risk but can be considered high-quality (or investment-grade), even though they are not backed by the U.S. government. Bonds that are more speculative and carry lower ratings (that is, below BBB-/Baa3 as rated by credit-rating agencies) are known as high-yield bonds. These bonds have more risk but may also offer the potential for higher returns. Investments in stable value portfolios are usually concentrated in higher quality sectors, with limited or no exposure to higher yielding, lower quality bonds.

Interest Rates and Term of the Bond:

Similar to changes in credit quality, changes in prevailing interest rates can also cause a bond’s price to vary. For a typical bond, the coupon income, which is set at issuance and is based on the bond’s face value and the then current level of interest rates, does not change over the term of the bond. However, the price that buyers are willing to pay for the bond will fluctuate, depending upon factors such as current interest rates, the issuer’s credit-quality rating, and the amount of time remaining until the bond’s maturity (term of the bond). Generally, if prevailing interest rates are moving higher, the existing bond’s price will fall. The converse also holds true – that is, if interest rates are moving lower, the bond’s price will rise. Barring default, the existing bond will still pay its periodic coupons and principal value at maturity, but the bond is now worth less (or more) as its coupon income is now lower (or higher) to compensate participants relative to what other bonds may pay in the market.

Duration:

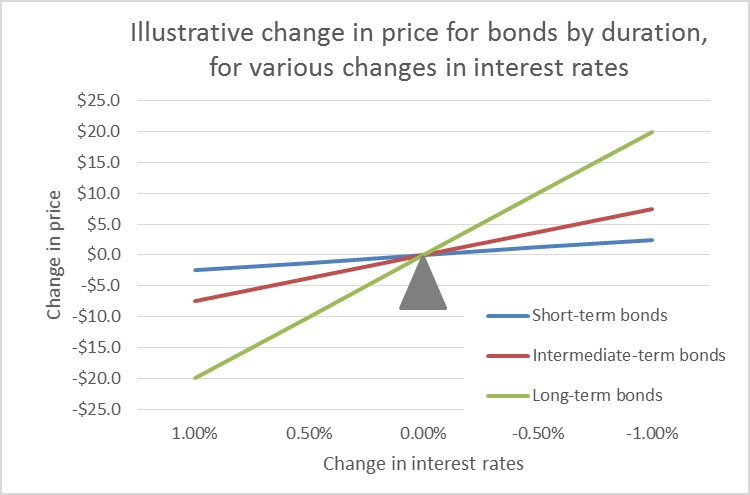

The measure of a bond’s price sensitivity to changes in interest rates is known as its duration which is generally tied to the term of the bond. The longer the duration of a bond, the greater its price sensitivity to changes in interest rates (and vice versa). In keeping with the objective of capital preservation, stable value portfolios are typically invested in short to intermediate term bonds, which limits price volatility.

Figure 2 illustrates this inverse relationship between bond prices and interest rates for short-, intermediate-, and long-term bonds.

Figure 2. Inverse relationship between price and rates

Figures are illustrative only: This hypothetical illustration does not represent the return on any particular investment. Durations of 2.5 years, 7.5 years, and 20 years were used for the short, intermediate and long-term bonds, respectively.

Notes: All investments are subject to risk. Investments in bonds and bond funds are subject to interest rate, credit, and income risk. Past performance is not a guarantee of future results.

Frequently Asked Questions about Synthetic Investment Contracts

Question: Given bonds’ daily price fluctuation, what makes the synthetic investment contract’s yield relatively stable?

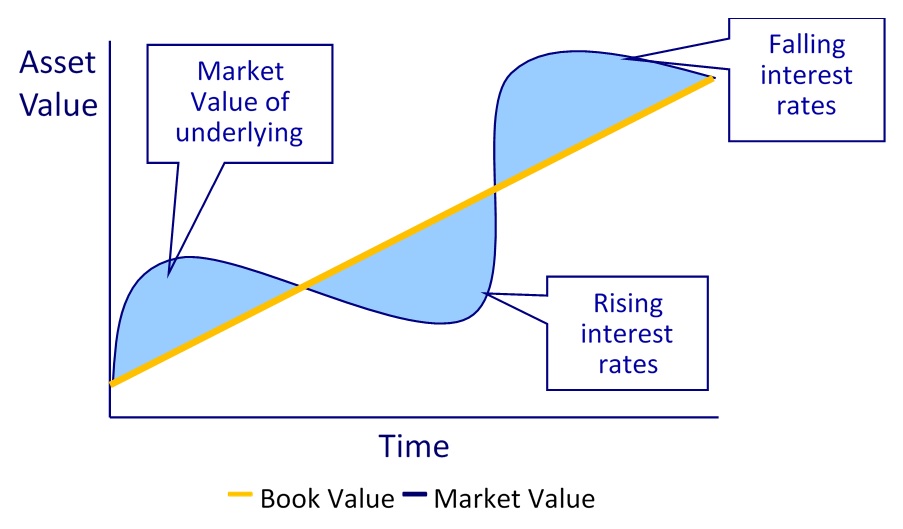

The terms of the synthetic investment contract specify how the market fluctuations of the underlying investments will be “smoothed” by the crediting rate over time. The contract yield is recalculated on a periodic basis, generally monthly or quarterly. As shown in Figure 3, the market value of the underlying investments and contract value will naturally diverge and converge over time. The magnitude may differ during certain periods when interest rates are rising or falling quickly or based on the level of withdrawals and deposits from the contract. It is important to note that even though the market value of the underlying investments fluctuates, synthetic investment contracts are designed to protect participants’ principal (deposits and earnings) and provide a steady credited yield under normal circumstances.

Figure 3. Market value of underlying investments fluctuates, but a stable value investment option’s assets grow at a more constant rate

Question: What happens if there are withdrawals when the market value of the underlying assets differs from the contract value of a synthetic investment contract?

Typically, participant-directed withdrawals are paid out at contract value irrespective of the market value of the underlying assets. Additionally, under certain circumstances, if all participants were to withdraw their balances and the underlying assets were fully depleted, the synthetic contract issuer is financially obligated to make up the difference owed to participants. This is the insurance-like feature of the synthetic investment contract. It is important to note that contracts may limit coverage for certain plan events or securities that have defaulted. (Please see accompanying box)

| Potential Limitations to coverage at contract value |

| While permitting liquidity, synthetic investment contracts may not cover all types of withdrawals at full contract value, such as those that are a result of plan changes and other plan-sponsor actions which can cause large cash flows out of the stable value investment option or significantly reduce participant contributions. These types of withdrawals can negatively impact participants and plans that choose to remain invested in the option. To treat participants equitably and to maintain reasonable costs, employer-initiated actions are not covered in most contracts. Such actions generally include, but may not be limited to, layoffs, sale of a division, plan-sponsor insolvency or bankruptcy, changes in a plan’s investment options, and communications encouraging a participant to withdraw from the stable value investment option. If the market value of the underlying investments is less than the contract value at the time of such withdrawals, the investments may still be paid out, but at a value less than contract value.Additionally, contracts may limit coverage for securities that have defaulted and contract value may be adjusted for these defaulted securities. |

Question: What else do I need to know about the synthetic investment contracts in my stable value investment option?

Your stable value investment option’s performance and level of risk is influenced by the investments underlying the contracts and the financial strength of the contract issuers. A review of the types of bonds and their relative weightings can provide insight into your stable value option’s performance. Typically, the underlying investments wrapped by the synthetic investment contracts are invested conservatively in bond portfolios that are well diversified, liquid and of overall, high credit quality.

As discussed earlier, your stable value investment option’s duration indicates the price sensitivity of the bonds in the underlying investments. It is also a reasonable estimate of the period of time over which the market gains or losses associated with the underlying investments are smoothed. Because of this averaging of gains and losses, both the change in your stable value investment option’s yield and its total return will lag behind the performance and yield of the underlying investments – both on the upside and downside – as shown in Figure 3. Over time, however, participants should earn the return of the underlying assets, less applicable fees, but without the principal volatility normally associated with bond funds.

Stable value investment options are generally considered to be one of the more conservative options offered within defined contribution plans and are designed to provide plan participants with stability of principal and accrued interest. As such, stable value plays an important role in helping retirement plan participants accumulate and protect retirement savings.

Appendix

| Stable Value Contract Structures | Description | Rate of Return | Assets |

| Guaranteed Insurance Accounts: General Accounts | Contracts and agreements with an insurance company that provide principal preservation, benefit responsiveness, and a guaranteed fixed or indexed rate of return backed by the assets of the insurer’s general account. | Guaranteed regardless of the performance of the underlying assets. | Owned by the insurance company and held within the insurer’s general account. |

| Guaranteed Insurance Accounts: Separate Accounts | Contracts and agreements with an insurance company that provide principal preservation, benefit responsiveness, and a guaranteed rate of return backed first by assets held in a segregated account separate from the insurer’s general account and then, to the extent there are any shortfalls, by assets in the general account. | May be fixed, indexed, reset periodically, or based on the actual performance of the segregated assets. | Owned by the insurance company but set aside in a separate account for the exclusive benefit of the plan(s) in the separate account. |

| Synthetic GICs | Contracts and agreements with a bank or insurance company that provide principal preservation, benefit responsiveness, and a guaranteed rate of return relative to a portfolio of assets held in an external trust and backed by assets held in the trust. | Provides a periodic rate of return based on the actual performance of the underlying assets. | Directly owned by the participating plan(s). |