The financial markets have historically experienced volatility and market uncertainty, which remain key themes in today’s markets. Investors saving for retirement are challenged to find strategies to generate enough income after inflation to last through their retirement years. Even modest inflationary pressures can eat into retirement savings and reduce actual purchasing power of money. This is especially true for investors approaching retirement age looking for stable returns and also investors who cannot tolerate market swings. An investment option that could help in these situations is a stable value fund.

Although stable value offers smooth and predictable returns, critics suggest that stable value may not be able to keep pace with inflation. Inflation is a measure or estimate of a general increase in the overall price level of the goods and services in the economy and results in a decrease in the purchasing power of money over time. For example: We pay more for a loaf of bread today than we did twenty years ago.

Investment returns are most often presented in nominal values, where the value of a fund today is compared to the value of the fund in a prior period. The value of an investment return in real dollars is actually less than the nominal return presented to investors on their portfolio statements because of the impact of inflation. If your portfolio increased five percent but inflation was two percent for that same period, your portfolio actually only earned three percent when adjusted for purchasing power. This is known as your “real return”, or return after inflation.

Inflation is measured by the Consumer Price Index (CPI) where the CPI represents a “basket” of items (i.e., goods and services that people purchase for day-to-day living). Every item in this basket has a price, which changes over time. The annual rate of inflation is the price of the total basket in a given month compared with its price in the same month one year previously, the “CPI value”.

Why is real return important? Despite recent years of slow economic growth, prices have increased over time. According to Poul Kristensen, CFA, Managing Director and Economist at New York Life, “Inflation may be low by historical standards, but it is not zero, and the current low yield environment therefore brings challenges for many investors. Over time, inflation can significantly erode the purchasing power of savings, and investors planning for retirement need to focus on real, i.e. inflation-adjusted, returns when allocating their investments.” Even though the overall CPI may be low, it could adversely impact consumers depending on what items they purchase. For example, increases in food prices may have a greater impact than a change in energy prices.

New York Life examined the impact of inflation on stable value returns and other conservative investment products to determine if investors are able to keep pace with rising prices using CPI.

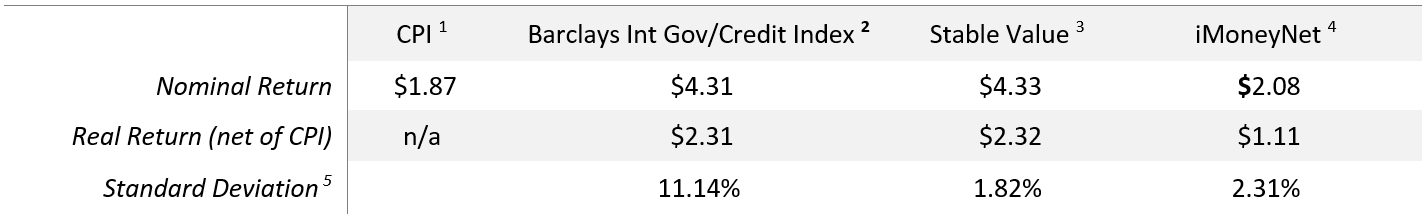

In order to show the impact of inflation using CPI, we compared the growth of a dollar in nominal and real returns for stable value funds (based on a hypothetical portfolio as published by SVIA), money market funds (as measured by iMoneyNet), and the Barclays Capital U.S. Intermediate Government/Credit Bond Index from 1990 to 2015. We also examined the standard deviation5 of returns for the three asset classes to compare volatility in returns.

TABLE 1: COMPARISON OF GROWTH OF A DOLLAR PERIOD 1990-2015

Returns are gross of all fees and expense which, if included, would reduce the returns shown. The duration of the index and stable value funds are longer than money market funds.

From the table above, we can see that all three products were able to keep pace with inflation. However, only stable value funds and bonds were able to provide income over the rate of inflation. Real returns for stable value funds and bonds more than doubled over the period, whereas money market fund real returns were essentially nonexistent. Although stable value fund returns were comparable to the Barclays Intermediate Government Credit Index, they had very little volatility as demonstrated by the low standard deviation.

Money market funds, on the other hand, offer the same level of stability as stable value funds but with generally lower returns. Currently, some money market fund returns are unable to keep up with inflation, with annual rates of 0.02% (iMoneyNet MFR).

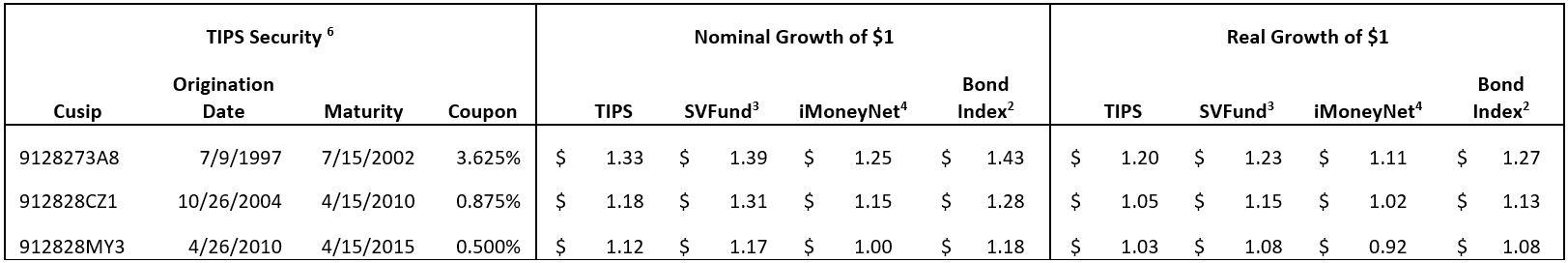

Using Treasury Inflation Protection Securities or “TIPS” with five year maturities, we can compare actual inflation-protected investable securities to investment option returns available in defined contribution plans. New York Life found three five-year bonds issued as far back as 1997 that covered the periods listed in the table below.

TABLE 2: GROWTH OF A DOLLAR INVESTED IN SELECTED TIPS AND OTHER CONSERVATIVE PRODUCTS

The results were consistent with what New York Life uncovered during the longer single period above; stable value fund and bond fund returns are competitive in each period on both a nominal and real basis. Despite anemic inflation growth from 2010 through 2015, money market fund real returns were negative. Stated another way; Investors lost purchasing power by investing in money market funds.

Although stable value funds and bonds had comparable returns over the period, the volatility experienced with investing in bonds may be hard to stomach for investors approaching retirement.

In sum, adding stable value as a fundamental component of your retirement plan, especially as you approach retirement not only provides capital preservation of your assets but in the past has also kept up with inflation while providing steady returns.

This article is for general informational purposes only and represents the views and opinions of its authors. Individuals should evaluate their own personal needs before making decisions regarding their financial situation. New York Life does not provide investment, legal or tax advice. Consult your financial advisor or consultant about what is right for you. All investments are subject to risk, including the possible loss of the money you invest. Past performance is no guarantee of future returns.

Footnotes: