By Gina Mitchell, SVIA

EBRI/ICI’s 401(k) database continues to provide the most definitive look at 401(k) plans. Their latest report, “401(K) Plan Asset Allocation, Account Balances, and Loan Activity in 2013,” covered 26.4 million plan participants in 72,676 plans that held $1.912 trillion in assets. The comprehensive 2013 report covers half of all 401(k) participants, 15 percent of all plans and 46 percent of all 401(k) assets.

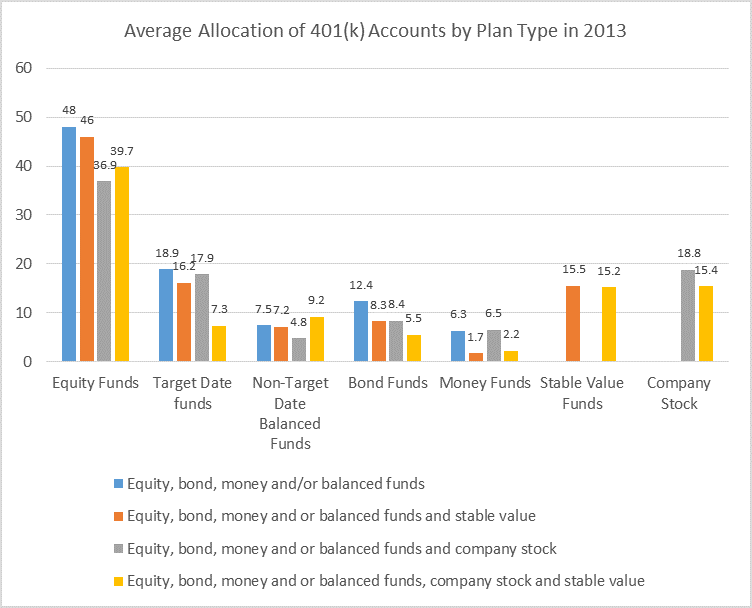

The report looks at four types of plans, which are detailed below. Only two of the plans offer stable value funds. However, plans with a stable value investment option represent 27.5 percent of all plans, 38.6 percent of participants and 45.8 percent of assets in 2013.

| Plan investment options | Plans | Participants | Assets |

|---|---|---|---|

| Equity, bond, money and/or balanced funds | 51,627 | 11,387,080 | $675,147,619,313.00 |

| Equity, bond, money and or balanced funds and stable value | 19,200 | 5,896,114 | $405,545,092,819.00 |

| Equity, bond, money and or balanced funds and company stock | 1,073 | 4,841,913 | $362,256,152,200.00 |

| Equity, bond, money and or balanced funds, company stock and stable value | 776 | 4,296,253 | $469,513,431,701.00 |

| All | 72,676 | 26,421,360 | $1,912,462,296,033.00 |

Based on the four plan investment options, the report found that plans with equity, bond, money and or balanced funds and stable value allocated 15.5 percent of assets to stable value and plans with equity bond, money or balanced funds, company stock and stable value allocated 15.2 percent to stable value.

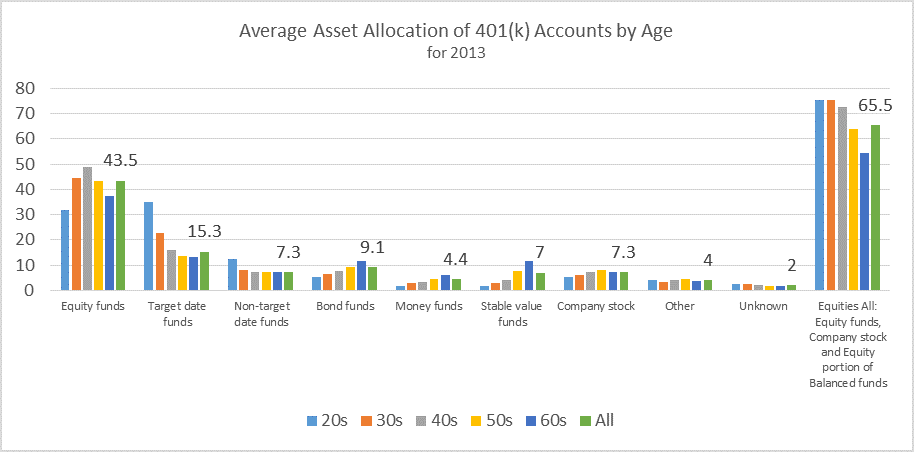

The EBRI/ICI report found that allocation to equity was 66 percent when equities through equity funds, the portion of their balanced funds, and company stock were included. This broader capture of equity asset classes raised participants’ exposure to equities across all age groups. EBRI/ICI found that 20 percent was allocated to fixed income securities such as stable value funds, bond funds and money funds. The following graph provides an overview of asset allocation for 2013.

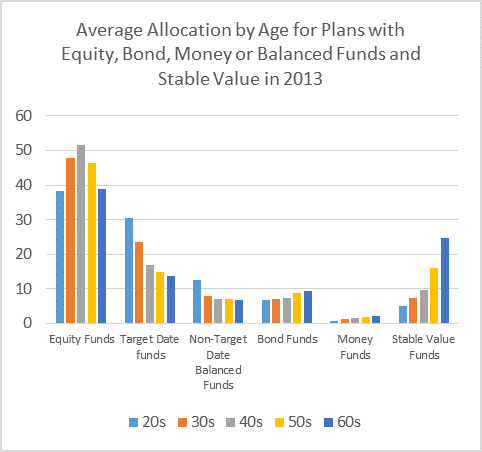

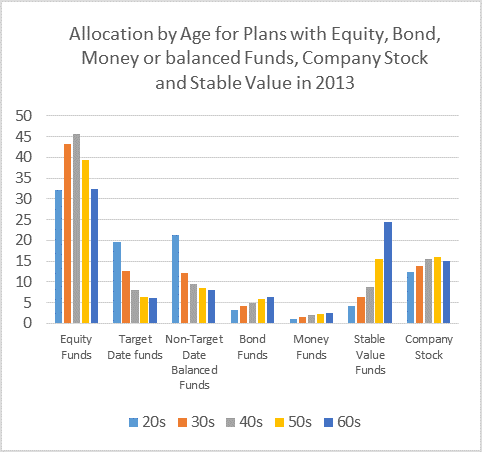

Focusing on asset allocation for plans that offered stable value, the EBRI/ICI found increasing allocations to equities across all ages. The data also shows allocations to stable value increased with age. The highest allocations to stable value were found in the older age cohorts: 50s and 60s respectively for both plan types with stable value with 15.9 and 24.6 percent respectively for plans with stable value and 15.6 and 24.5 for plans with stable value and company stock.

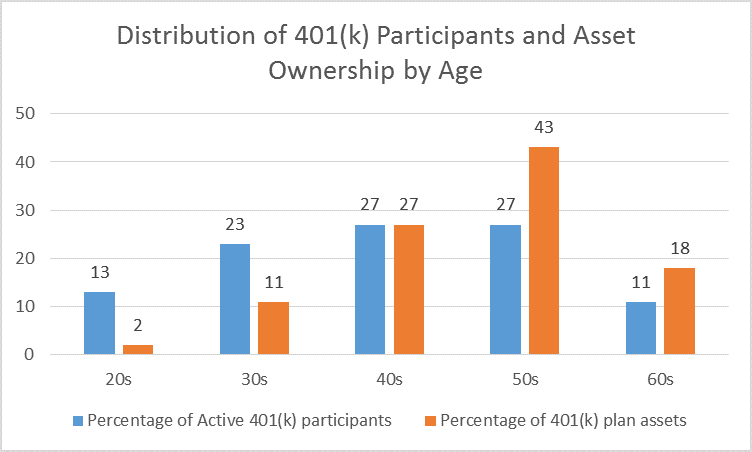

EBRI/ICI also reported those 50 and older held 61 percent of the assets in 2013 and represented 38 percent of the active participants covered. Further, EBRI/ICI found that the median age for a plan participant was 46 and the average age for a plan participant was 42.

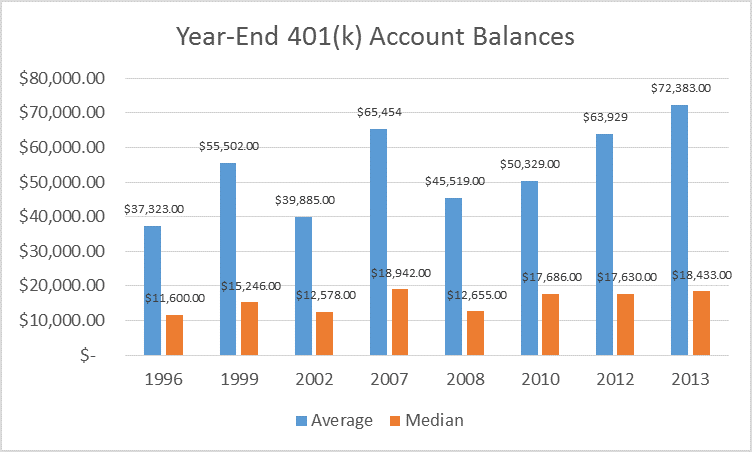

EBRI/ICI found the average account balance was $72,383 in 2013. However, the median balance was $18,433 but noted there was wide variation in balances by stating that 75% of the participants in the database had account balances lower than 2013’s average balance of $72,383. Further, they found that almost 40 percent had account balances less than $10,000 while almost 20 percent had balances above $100,000. They explained these variations were due to participant age, tenure, salary, contributions, rollovers from other plans, asset allocation, withdraws, loan activity and employer contribution rates.